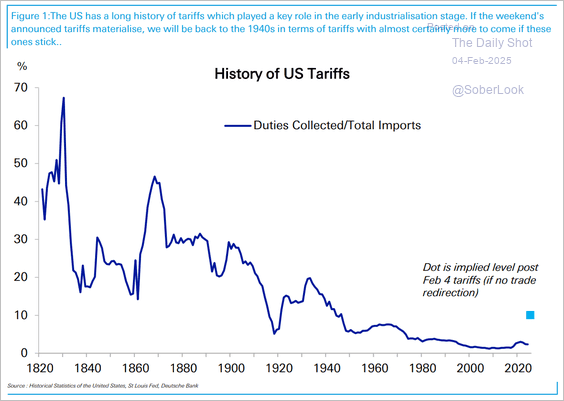

Tariffs, A History

While we’re sure everyone is sick of talking about tariffs, the magnitude of recent events compels us to include this chart. Tariffs have been nowhere near the current/proposed levels since war times, and the sheer scope of the economic impact, assuming they stay in place for a reasonable period, will have generational impacts.

We are monitoring the ever-evolving situation closely, which unfortunately (somehow) seems to mean primarily keeping our eye on Twitter (X).

On the optimistic side, we are confident that volatility will be the friend of a defensive portfolio over the long term. But it would be nice if it didn’t come at the expense of a trade war!

2035: An Allocator Looks Back Over the Last 10 Years

Cliff Asness retains his ability to make academic topics in investing—asset allocation in this case—kind of funny.

This article is a hypothetical lookback at an endowment’s last 10 years in their 2035 annual letter. There are many things that are likely to seem obvious in the long term but may be hard to adhere to in the short term here.

Frankly, the only thing that worked for us in this space was our splitting the 10% crypto allocation 90% bitcoin and 10% into the only cryptocurrency that ended up being worth anything substantial by 2035.

It turned out that, just as we thought, the U.S. really did have the best companies (most profitable, most innovative, fastest growing) and this indeed continued in this last decade. But it also turned out that paying an epic multiple for the U.S. compared to the rest of the world mattered somewhat more than we thought, and international diversification, as we knew it would one day, did eventually work. It turns out there was indeed a price at which European stocks made sense.

Steve Jobs’s Rock Tumbler Metaphor

There is a tremendous amount of craftmanship (i.e. work) in between an idea and a product or business. This is a short but excellent vintage Steve Jobs clip on the art of managing tradeoffs.

Every day you discover something new. A new problem, or a new opportunity.

Berkshire’s 2024 annual letter

It will be a sad day when we no longer have the privilege of including a new Berkshire letter penned by Warren Buffet. Buffet is still amongst the sharpest minds in the world at age 94, so we are hoping that day is still years into the future.

During the 2019-23 period, I have used the words “mistake” or “error” 16 times in my letters to you. Many other huge companies have never used either word over that span.

USA Inc. Revisited (Mar 2025)

An update to Mary Meeker’s classic 2011 report USA Inc., A Basic Summary of America’s Financial Statements. The report is a frank assessment of the state of the United State’s finances as though it were a business.

Given we just referenced the Berkshire annual letter, it feels appropriate to quote the 2018 letter which dove deep on this topic. The debt is absolutely going to matter at some point (maybe soon for short-term trading), but over the long term it is best to keep the below in mind.

Those who regularly preach doom because of government budget deficits (as I regularly did myself for many years) might note that our country’s national debt has increased roughly 400-fold during the last of my 77-year periods. That’s 40,000%! Suppose you had foreseen this increase and panicked at the prospect of runaway deficits and a worthless currency. To “protect” yourself, you might have eschewed stocks and opted instead to buy 31⁄4 ounces of gold with your $114.75.

And what would that supposed protection have delivered? You would now have an asset worth about $4,200, less than 1% of what would have been realized from a simple unmanaged investment in American business. The magical metal was no match for the American mettle.

Gallant MacDonald designs bespoke investment programs for a select group of institutions and families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!